Zumosun Venture Capital Work Engine

Zumosun's Venture Capital Work Engine provides a comprehensive suite of services and solutions designed to support startups and high-growth companies in securing funding and scaling their operations. This platform combines expertise in syndicated and leveraged finance with a focus on venture capital, offering strategic planning, execution, and management of investment processes. Below, we delve into the detailed components of the Zumosun Venture Capital Work Engine, covering all aspects necessary for a successful venture capital strategy.

Introduction to Venture Capital

Venture Capital (VC) is a form of private equity financing provided by investors to startups and early-stage companies with high growth potential. Venture capitalists invest in these companies in exchange for equity, taking on significant risk in the hopes of achieving substantial returns. VC is crucial for companies that lack access to traditional financing sources, such as bank loans or public markets.

Types of Venture Capital Investments

- Seed Capital: Initial funding to help a startup develop its idea and create a prototype.

- Early-Stage Capital: Financing provided to companies that have developed a product but require funds for scaling production and market entry.

- Growth Capital: Funding for expanding operations, entering new markets, or scaling production capabilities.

- Late-Stage Capital: Investments in companies with proven business models, seeking further expansion or preparing for an IPO.

- Mezzanine Financing: A hybrid of debt and equity financing, typically used in later stages to prepare for an IPO or acquisition.

Advantages and Disadvantages

Advantages:

- Access to Capital: Provides essential funding for startups that might not qualify for traditional loans.

- Expertise and Mentorship: Investors often provide valuable guidance and industry connections.

- Scalability: Helps companies rapidly scale operations and reach new markets.

Disadvantages:

- Equity Dilution: Founders must give up a portion of ownership and control.

- High Expectations: Pressure to achieve significant growth and profitability.

- Exit Strategies: VCs typically require an exit plan, such as an IPO or acquisition, within a few years.

Vendors and Partners

- VC Firms: Primary investors providing funding and expertise.

- Angel Investors: Individual investors offering seed capital and mentorship.

- Legal and Financial Advisors: Provide legal, financial, and regulatory guidance.

- Accelerators and Incubators: Offer support services, mentorship, and sometimes initial funding.

Strategies and Planning

- Market Research: Comprehensive analysis of industry trends, competitive landscape, and market potential.

- Business Model Evaluation: Assessing the viability and scalability of the startup's business model.

- Due Diligence: Thorough examination of the startup's financials, management team, and market positioning.

- Valuation and Term Sheet Negotiation: Determining the company's valuation and negotiating investment terms.

- Post-Investment Management: Ongoing support and guidance to ensure business growth and success.

Programs and Tools

- Investment Platforms: Tools for managing deal flow, due diligence, and portfolio management.

- Market Intelligence Tools: Analytics platforms for tracking market trends and competitor activity.

- Financial Modeling Software: Tools for projecting financial outcomes and valuations.

- Communication Platforms: Systems for maintaining regular communication with portfolio companies and co-investors.

Courses and Training

- Venture Capital Certification Programs: Professional certifications for venture capitalists and startup advisors.

- Workshops and Seminars: Focused on topics such as startup valuation, negotiation skills, and market analysis.

- Online Courses: Covering entrepreneurship, investment strategies, and financial analysis.

Platforms and Technology Integration

Zumosun integrates advanced technologies, including artificial intelligence (AI), machine learning (ML), and blockchain, to enhance the VC investment process. AI and ML models are used for predictive analytics, assessing market trends, and identifying promising investment opportunities. Blockchain technology ensures secure and transparent transactions, particularly in managing cap tables and equity distribution.

Cost, Time, and Resources

Cost: Costs include legal fees, due diligence expenses, and management fees. VCs may also charge a carried interest on profits.

Time: The investment process can take from several weeks to months, depending on the complexity of the deal.

Resources: Requires a team of analysts, legal experts, financial advisors, and industry specialists.

Certificates and Licenses

- Securities Licenses: Necessary for professionals involved in investment activities.

- Legal Certifications: For legal advisors ensuring compliance with regulatory requirements.

- Financial Analyst Certifications: Such as CFA or similar qualifications.

Expert Management and Workflow

- Project Management: Led by experienced venture capital professionals who oversee the entire investment lifecycle.

- Stakeholder Engagement: Regular updates and communications with investors, portfolio companies, and advisory boards.

- Risk Management: Continuous monitoring and mitigation of risks associated with investments.

Complete Cycle of Venture Capital

-

Fundraising

- Raising capital from Limited Partners (LPs) and institutional investors.

- Defining investment thesis and strategy.

-

Sourcing and Screening

- Identifying potential investment opportunities.

- Conducting initial assessments and screening.

-

Due Diligence

- In-depth evaluation of the startup's business model, financials, and market potential.

- Legal and regulatory due diligence.

-

Investment Decision

- Finalizing the terms and issuing a term sheet.

- Structuring the investment and closing the deal.

-

Post-Investment Management

- Providing strategic guidance and resources.

- Monitoring progress and ensuring alignment with growth objectives.

-

Exit

- Planning and executing exit strategies, such as IPOs, mergers, or acquisitions.

Comparison Matrix

| Variable | Seed Capital | Early-Stage Capital | Growth Capital | Late-Stage Capital | Mezzanine Financing |

| Investment Size | Small | Medium | Large | Large | Large |

| Risk Level | High | High | Moderate | Lower | Moderate to High |

| Equity Stake | Significant | Significant | Moderate | Lower | Lower (with debt component) |

| Investor Involvement | High (mentorship, guidance) | High | Moderate | Low to Moderate | Moderate |

| Time to Exit | Long (5-10 years) | Long (5-10 years) | Medium (3-7 years) | Short to Medium (2-5 years) | Short (1-3 years) |

Integration of Science, Technology, and Research

Zumosun leverages cutting-edge technology and rigorous research methodologies to enhance the efficiency and accuracy of venture capital investments. AI and data analytics provide deep insights into market dynamics, startup performance, and potential risks. Machine learning algorithms are employed to predict future market trends and identify the most promising investment opportunities. Blockchain technology ensures secure and transparent management of investment records, cap tables, and equity distribution, reducing the risk of fraud and enhancing trust among stakeholders.

This comprehensive approach ensures that Zumosun’s Venture Capital Work Engine not only provides capital but also adds value through strategic guidance, risk management, and technology integration, ultimately helping startups achieve their growth potential and ensuring successful investment outcomes.Contact us on 9116098980/9119112929 today or visit our website www.thelegalcourt.com , www.zumosun.com for a consultation and take the first step towards resolving your legal issues with confidence.

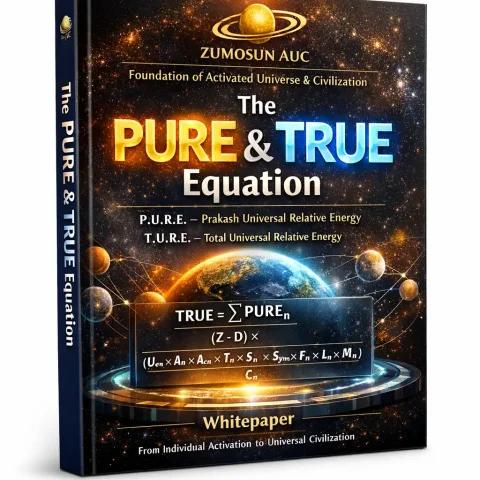

About The Author:-

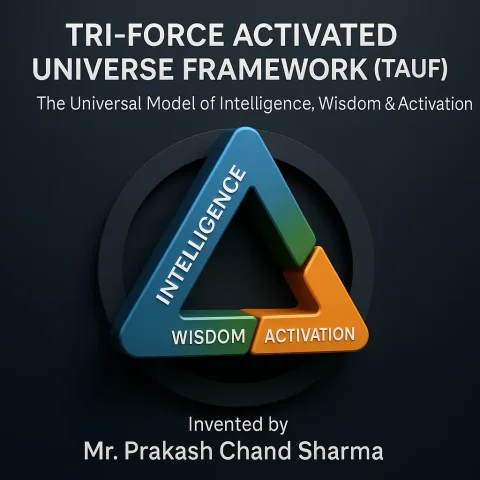

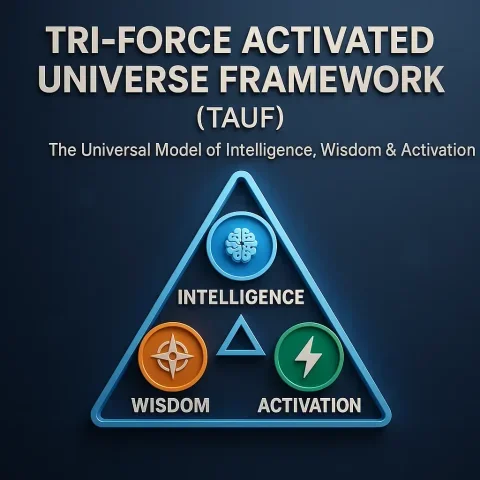

Prakash Chand Sharma, a multi-talented leader, defies labels. He's a pioneer of "The Doctorate of Growth & Success" and the Work Engine Network. Sharma seamlessly blends expertise in engineering, law, finance, and business.

His academic background (visiting professor) combined with engineering, legal practice, and tax consultancy experience showcases his intellectual depth. Over a decade of entrepreneurship across various sectors, coupled with leadership positions in multiple companies, has honed his strategic vision.

This unique blend positions Sharma as a transformative leader and a sought-after mentor. His visionary leadership has driven the success of the Zumosun Group, a diversified conglomerate. His dedication to growth extends beyond business with his innovative "The Do.GS" concept.

Follow On:-

1. https://www.linkedin.com/in/eng-adv-ca-d-prakash-chand-sharma-26586143/

2. https://www.facebook.com/er.adv.ca.prakash.chandsharma.35

No reviews found.

No comments found for this product. Be the first to comment!