How to online apply for Rajasthan money lending licence

Rajasthan Money lending licence provides the facilities for secure and unsecured finance business in the form of loan in Rajasthan. Every person, HUF, Firm, and company who want money lending business in Rajasthan require this licence mandatory according to Rajasthan money lending act,1963.

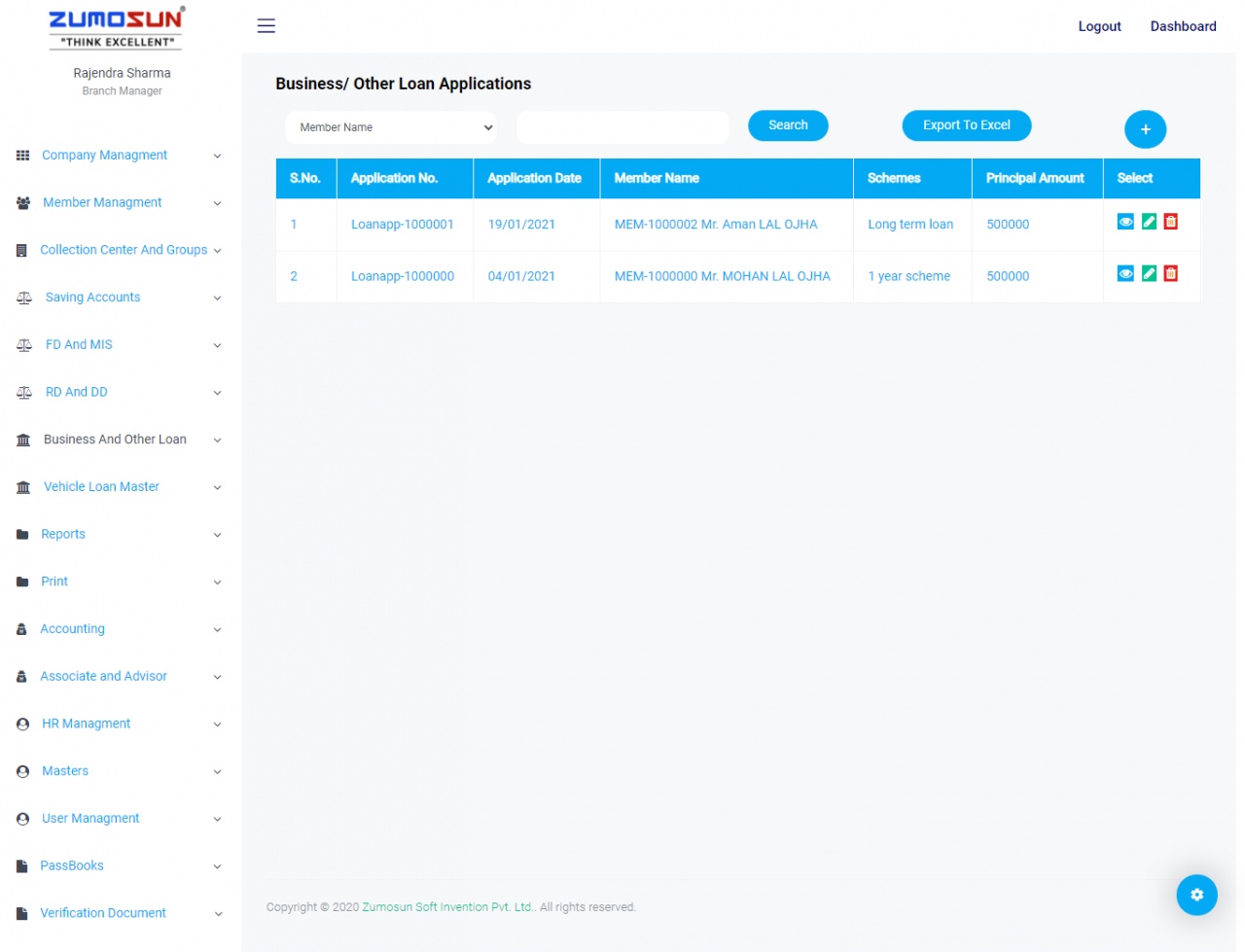

Zumosun Soft Group ( TheLegalBank, TheLegalCourt, Techlam ) consistently doing excellent, ethical, prudence, practice for Rajasthan money lending act,1963 and Rajasthan money lending rule,1965. Our professionals provide consultancy and advisory from starting the finance concept of secure and unsecured to apply and getting the money lending licence. All the compliances management including the interest rate and taxation and government filings. We are also providing the required software and digital infrastructure at our platform.

Who is Money Lender according to Rajasthan Money Lending Act,1963

(1) Every money-lender shall make an application in the prescribed form for the grant of a licence to the Assistant Registrar of the area within the limits of which the place, where he intends to carry on the business of money-lending, or if he intends to carry on such business at more than one place in the area, the principal place of such business, is situated.

(2) Such application shall contain the following particulars, name-

(a) the name in which such money-lender intends to carry on business and the name of the person proposed to be responsible for the management of the business;

(b) if the application is by or on behalf of-

(i) an individual, the name and address of such individual;

(ii) an undivided Hindu family, the names and addresses of the manager and the adult coparceners of such family;

(iii) a company, the names and addresses of the directors, manager or principal officer managing it;

(iv) an unincorporated body of individuals, the names and addresses of such individuals;

(c) the area and the place or principal place of the business of money-lending in the State;

(d) the name of any other place in the State where the business of money-lending is carried on or intended to be carried on:

(e) whether the person signing the application has himself, or any of the adult coparceners of an undivided Hindu family or any director, manager or principal officer of the company or any member of the unincorporated body on behalf of which such application has been made, as the case may be, has carried on the business of money-lending in the State in the year ending on the 31st day of March immediately preceding the date of the application either individually or in a partnership or jointly with any other coparcener or any other person and whether in the same or any other name;

(f) the total amount of the capital which such person intends to invest in the business of money-lending in the years for which the application has been made;

(g) if the places at which the business of money-lending is to be carried on are more than one, the names of persons who shall be in charge of the management of the business at each such place;

(h) such other particulars as may be prescribed.

(3) The application shall be in writing and shall be signed,-

(a) (i) if the application is made by an individual, by the individual:

(ii) if the application is made on behalf of an undivided Hindu family, by the manager of such family;

(iii) if the application is made by a company or unincorporated body, by the managing director or any other person having control of its principal place of business in India or of its place of business in the area in which it intends to carry on the business; or

(b) by an agent authorised in this behalf by a power of attorney by the individual money-lender himself, or the family or the company or the un-incorporated body, as the case may be.

Documents Requirements for Money Lending License

1. Income Tax return for the previous three financial years.

2. Resident certificate

3. Police Verification and Character certificate in two copies( attested by gazetted officer)

4. Last 1-year bank statement

5. Pan card of the applicant

6. Aadhar card of the applicant.

7. Details of the previous business, if any.

8. KYC of Partners, In case company, Firm or HUF

Procedure for application for the Rajasthan Money lending Licence

- Collect and arrange all documents from partners or individuals

- Communicate with our professionals through websites, email or mobile.

- Visit us on www.zumosun.com, www.thelegalbannk.comor mails us on thelegalbank@gmail.com

- Discuss with our professionals and satisfy all your queries, questions and doubts.

- Finalise the deal and start work-related licence procedure

- Provide us with all the required information and documents

- We will advise and draft the documents for your concern, approval with your signatures and appropriate communication.

- Our professionals follow up with all relevant departments and ministries.

- Once the department verified all the documents and satisfied them according to the act and rules of Rajasthan Money Lending Act 1963.

- Appropriate office or Sub-registered issue the licence

The validity of Money lending Licence

Money lending licence shall be valid for a period of three years from the date of its issue: Provided that when an application for renewal of a licence has been received by an Assistant Registrar within the prescribed period, the licence shall until the application is finally disposed of, be deemed to be valid.

Interest Rate and Compliance Management

(1) No money-lender shall recover the interest in respect of any loan advance by him, an amount in excess of the amount of principal.

(2) Any loan in respect of which the money-lender has released from the debtor an amount equal to or more than twice the amount of the principal, shall stand discharged and the amount, if any, so realised in excess of twice the amount of the loan shall be refunded by the money-lender to the debtor:

Provided that no refund shall be made if such excess amount had been released prior to three years from the date of commencement of the Rajasthan Money-lenders (Amendment) Act, 1976.]

Power of court to direct payment of the decretal amount by instalments.

Notwithstanding anything contained in the Code of Civil Procedure, 1908 (Central Act V of 1908), the court may, at any time, on the application of a judgment-debtor, after notice to the decree-holder, direct that the amount of any decree passed against him, whether before or after the date on which this Act comes into force, in respect of a loan shall be paid in a such number of instalments and subject to such conditions, and payable on such dates, as, having regard to the circumstances of the judgment-debtor and the amount of the decree, it considers fit:

Provided that nothing contained in this section shall apply to a decree passed under Order XXXIV of the First Schedule to the said Code.

Limitation on rates of interest money lending licence in Rajasthan

(1) The State Government may, from time to time, by notification in the Official Gazette, fix the maximum rates of simple interest for any class of business of money-lending in respect of secured and unsecured loans,

(2) No money-lender shall charge or receive from a debtor interest at a rate exceeding the maximum rate fixed by the State Government under sub-section (1).

(3) Notwithstanding anything contained in any law for the time being in force, no agreement between a money-lender and a debtor for payment of interest at rates exceeding the maximum rates fixed by the State Government under sub-section (1) shall be valid and no court shall, in any suit to which this Act applies, award interest exceeding the said rates.

(4) If any money-lender charges or receives from a debtor interest at the rate exceeding the maximum rates fixed by the State Government under sub-section (1), he shall, for the purpose of section 40 be deemed to have contravened the provisions of this Act.

Prohibition of charge for expenses on loans by moneylenders

No money-lender shall receive from a debtor or intending debtor any sum other than reasonable costs of investigating title to the property, costs of the stamp, registration of documents and other usual out-of-pocket expenses in cases where an agreement between the parties includes a stipulation that property is to be given as security or by way of mortgage and where both parties have agreed to such costs and reimbursement thereof, or where such costs, charges or expenses are leviable under the provisions of the Transfer of Property Act, 1882 (Central Act IV of 1882) or any other law for the time being in force.

Notice and information to be given on assignment of loans

(1) Where a loan advanced, whether before or after the date on which the Act comes into force, or any interest on such loan or the benefit of any agreement made or security is taken in respect of such loan or interest is assigned to any assignee, the assignor (whether he is the money-lender by whom the money was lent or any person to whom the debt has been previously assigned) shall before the assignment is made-

(a) give the assignee notice in writing that the loan, interest, agreement or security is affected by the operation of this Act,

(b) supply to the assignee all information necessary to enable him to comply with the provisions of this Act, and

(c) give the debtor notice in writing of the assignment supplying the name and address of the assignee.

(2) Any person acting in contravention of the provisions of subsection (1) shall be liable to indemnify any other person who is prejudiced by the contravention.

Bottom Line:-

We invite all the finance business owners who want the money lending licence of secure and secure loan business in Rajasthan including MSME, Startups, Enterprises, Unprofessional, and professionals are welcome on our business university as a supper app and quantum platform for money lending licence. We are ready to support our every business partner according to industry 4.0, and 5.0. You can contact us on 9116098980/9119112929. You can visit on www.zumosun.com or mail us on zumosunsoft@gmail.com

Referral and Affiliate Collaboration

We invite all the people and businesses to empower themselves as well as our friends. You can refer this link to your friends who need these services and information to solve the problem by the professionals and you can earn the best trust and financial rewards in many forms. We have every type of infrastructure for you and your friends business from company incorporation to website, app, software development, Legal services. Everyone can buy and sell on our platform everything at any time.

Researcher and Writers: -

1.Intellectual Property Owner:- Zumosun Soft Group*,

2.Product Research & Invention Directors:-Scientist, Engineers, Advocates, Financers, Economist, Chartered Accountants, Company Secretary, Professionals Team**

3.Images, Design, Video, UX/UI,Technology & Intelligence Directors :- Eng. Devendra Chaudhary***

4.Technical Knowledge Directors:- ACA Jayesh Sharma****

5.Technical Knowledge Officers:- ACS Neetu Sharma*****

6.Marketing & Sales Directors:- Prakash Chand Sharma******

Founders, Designated Partners & Associate of Zumosun Group

Mobile: +91 9116098980/9119112929 email: thelegalbank@gmail.com

**Know more about our services and Research**

We are here to solve your cluster problems related to how to apply for an online Rajasthan money lending licence. You can know more about your correlative services, goods, products on our platform.

Internal Links

We have many more services and products for your Rajasthan money lending licence relative problems and possible solutions on our platform.

- https://www.zumosun.com/how-to-apply-get-for-money-lending-licence-in-rajasthan-734

- https://www.zumosun.com/documents-required-for-nbfc-micro-finance-company-registration-in-jaipur-rajasthan-17

Research References:-

Our professionals do deep research, and development to make Rajasthan money lending licence online apply in terms of efficiency and quality in real-time. We take the reference from academia and industries trends for Rajasthan money lending licence online apply.

1.http://www.bareactslive.com/Raj/RJ675.HTM

3.http://www.bareactslive.com/RAJ/RJ676.HTM

4.https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=10196

Relative Research & Invention References:-

Our professional's constantly do an analysis of all the relative and correlation references for research to optimise the services of how to online apply for Rajasthan money lending licence.

- https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=3764

- https://rbidocs.rbi.org.in/rdocs/Content/PDFs/SFB05122019_FL3EC4152CCF764BCBA2072CADC84906F7.PDF

External Links

Our professional's constantly do an analysis of all the relative and correlation references for research to optimise the services of how to online apply for Rajasthan money lending licence through external links and resources.

- https://www.rbi.org.in/scripts/PublicationReportDetails.aspx?UrlPage=&ID=513

- https://www.indiacode.nic.in/bitstream/123456789/6595/1/(8_of_2014)_reprint_mah._money_lending_(regulation)_act._2014_(h_4192).pdf

Industries References

Our professionals constantly do an analysis of all the relative and correlation references for research from industries to optimise the services of how to online apply for Rajasthan money lending licence through external links and resources.

Journal, Magazine, Reports

Our professionals constantly do an analysis of all the relative and correlation references for research from the journal, magazine, reports optimising the services of how to online apply for Rajasthan money lending licence through external links and resources.

Academic Reference

Our professionals constantly do an analysis of all the relative and correlation references for research from academia to optimise the services of how to online apply for Rajasthan money lending licence through external links and resources.

3.https://www.igi-global.com/article/social-media-based-forecasting/148147

Reference Books:-

Our professionals constantly do an analysis of all the relative and correlation references for research from books to optimise the services of how to online apply for Rajasthan money lending licence through external links and resources.

1.Rajasthan Money Lending Act,1963 by Shivalal Gupta- https://books.google.co.in/books/about/Law_Relating_to_Money_Lendings_in_Rajast.html?id=V4veGwAACAAJ&redir_esc=y

Co-citation Metrics for how to online apply for Rajasthan Money Lending Licence

Our professionals constantly do an analysis of all the relative and correlation references for research from co-citation to optimise the services of how to online apply for Rajasthan money lending licence through external links and resources.

1.https://compliancesolution.in/money-lending-license/

2.https://fastlegal.in/academy/money-lending/money-lending-licence/

3.https://www.indiafilings.com/learn/money-lender-license/

DISCLAIMER

While every care has been taken in the preparation of this information/report/flowchart/presentation/video to ensure its accuracy at the time of publication ZUMOSUN SOFT GROUP, Techlam Legal Business (TLB) LLP assumes no responsibility for any errors which despite all precautions, may be found herein. Neither this information/report/flowchart/presentation/video nor the information contained herein constitutes a contract or will form the basis of a contract. The material contained in this document does not constitute/substitute professional advice that may be required before acting on any matter. Professional advice must be taken before acting. This information/report/flowchart/presentation/video is for general guidelines only.

*COPYRIGHT NOTICE**

© 2021, India. All Rights reserved with (ZUMOSUN SOFT GROUP)®, Techlam Legal Business (TLB) LLP Branded by (“TheLegalCourt”) TM, and (“TheLegalbank”) ®, B-4/193, Chitrakoot Scheme, Vaishali Nagar, Jaipur-302021